Obtaining mortgage financing in Miami as a foreigner is more accessible than many imagine. With the right strategies, proper documentation, and knowledge of available programs, international investors can access competitive credit to maximize their purchasing power and optimize returns.

Mortgage financing for foreigners in Miami represents a real and accessible opportunity to maximize purchasing power and optimize investment returns. Contrary to what many believe, there are specific programs and specialized banks that offer competitive conditions for international investors.

This comprehensive guide explores all available options, from traditional American banks to international institutions, detailing requirements, approval strategies, and practical tips to obtain the best conditions. With the right knowledge, you can access financing that can represent up to 70% of the property value, freeing up capital for diversification or other investments.

Overview of Financing for Foreigners

The American mortgage market has evolved significantly to accommodate international investors, especially in markets like Miami.

Historical Evolution

Regulatory changes:

- Pre-2008: More liberal access

- 2008-2015: Post-crisis restrictions

- 2015-present: Gradual reopening

- Current trend: Specialized programs

Driving factors:

- International demand: Steady growth

- Banking competition: Search for new markets

- Regulation: Stabilization of rules

- Technology: Process simplification

Current Scenario

Market volume:

- Foreign participation: 15-20% of purchases in Miami

- Financing: 40-50% of foreign buyers

- Growth: 8-12% per year

- Average ticket: US$ 800K – US$ 2M

Borrower profile:

- Latin Americans: 40% of foreign market

- Europeans: 20% of market

- Canadians: 15% of market

- Others: 25% of market

Types of Available Programs

There are different financing modalities, each with specific characteristics and distinct target audiences.

Foreign National Programs

General characteristics:

- LTV: 50-70% of property value

- Term: 15-30 years

- Amortization: Fixed or adjustable rate

- Prepayment: Generally without penalty

Basic requirements:

- Down payment: 30-50% of value

- Income: International verification

- Credit: History when available

- Reserves: 2-6 months of payments

Bank Statement Programs

Specific modality:

- Verification: Bank statements (12-24 months)

- Income: Calculated on average deposits

- Flexibility: Greater for self-employed

- Documentation: Reduced

Advantages:

- Simplicity: Less bureaucracy

- Speed: Faster approval

- Flexibility: Accepts variable income

- Privacy: Less fiscal exposure

Asset-Based Lending

Characteristics:

- Guarantee: Asset-based

- LTV: Up to 75% in some cases

- Term: Generally shorter

- Rates: Slightly higher

Target audience:

- High net worth: Elevated assets

- Entrepreneurs: Complex income

- Investors: Multiple properties

- Retirees: Investment income

Main Banks and Institutions

The market offers several options, from large American banks to specialized institutions.

Traditional American Banks

Bank of America:

- Program: International Client Program

- LTV: Up to 70%

- Term: 15-30 years

- Differential: Global relationship

- Requirements: Minimum assets US$ 1M

Wells Fargo:

- Program: Foreign National Lending

- LTV: Up to 65%

- Term: 15-30 years

- Differential: National presence

- Requirements: Verified income

Chase Bank:

- Program: International Private Client

- LTV: Up to 70%

- Term: 15-30 years

- Differential: Premium services

- Requirements: Banking relationship

Specialized Banks

HSBC:

- Program: International Banking

- LTV: Up to 70%

- Term: 15-30 years

- Differential: Global presence

- Requirements: Account in country of origin

Santander:

- Program: International Mortgage

- LTV: Up to 65%

- Term: 15-30 years

- Differential: Hispanic focus

- Requirements: Regional relationship

Citibank:

- Program: Global Client Mortgage

- LTV: Up to 70%

- Term: 15-30 years

- Differential: International network

- Requirements: Citibank relationship

Requirements and Documentation

Documentation for foreign financing is more extensive than for residents, but perfectly viable.

Personal Documents

Identification:

- Passport: Valid with American visa

- ITIN: Individual Taxpayer Identification Number

- Proof of residence: In country of origin

- Marital status: Marriage certificate if applicable

Additional documentation:

- Curriculum vitae: Professional history

- References: Personal and commercial

- Letter of intent: Investment purpose

- Life insurance: When required

Financial Documents

Income verification:

- Tax return: 2-3 years

- Bank statements: 3-6 months

- Salary proof: If employed

- Business statements: If entrepreneur

Asset verification:

- Investment statements: Stocks, funds, etc.

- Property appraisal: Existing properties

- Business statements: Corporate participations

- Other assets: Vehicles, art, etc.

Property Documents

Basic documentation:

- Purchase agreement: Contract

- Appraisal: Appraisal report

- Inspection: Property inspection

- Insurance: Homeowner’s insurance

Specific documents:

- HOA documents: For condominiums

- Survey: Topographic survey

- Title report: Title report

- Flood certification: Flood certificate

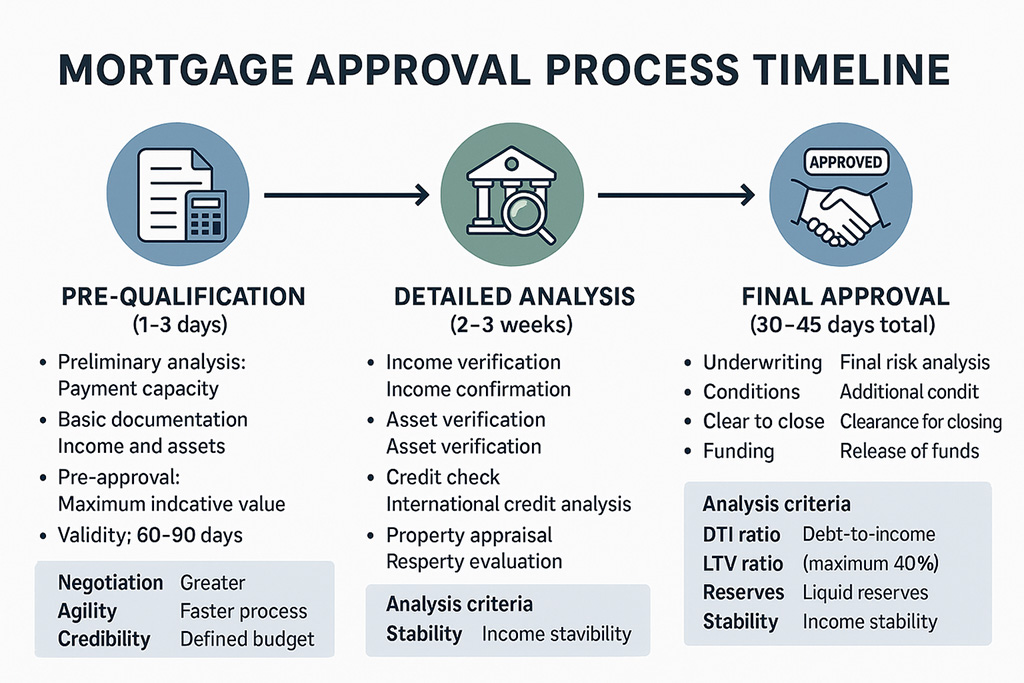

Approval Process

The approval process follows specific steps that can be optimized with adequate preparation.

Pre-Qualification

Initial stage:

- Preliminary analysis: Payment capacity

- Basic documentation: Income and assets

- Pre-approval: Maximum indicative value

- Validity: 60-90 days

Benefits:

- Negotiation: Greater bargaining power

- Agility: Faster process

- Credibility: Demonstrated seriousness

- Planning: Defined budget

Detailed Analysis

In-depth verifications:

- Income verification: Income confirmation

- Asset verification: Asset verification

- Credit check: International credit analysis

- Property appraisal: Property evaluation

Analysis criteria:

- DTI ratio: Debt-to-income (maximum 43%)

- LTV ratio: Loan-to-value (maximum 70%)

- Reserves: Liquid reserves

- Stability: Income stability

Final Approval

Final steps:

- Underwriting: Final risk analysis

- Conditions: Additional conditions

- Clear to close: Clearance for closing

- Funding: Release of funds

Typical timeline:

- Pre-qualification: 1-3 days

- Documentation: 1-2 weeks

- Analysis: 2-3 weeks

- Approval: 30-45 days total

Rates and Conditions

Financing conditions vary according to the bank, program, and client profile.

Rate Structure

Interest rate:

- Typical range: 6.5% – 9.5% per year

- Factors: Risk profile, LTV, term

- Type: Fixed or variable

- Benchmark: Prime rate + spread

Additional fees:

- Origination fee: 0.5% – 2% of loan

- Processing fee: US$ 500 – US$ 1,500

- Appraisal fee: US$ 400 – US$ 700

- Credit report: US$ 50 – US$ 100

Condition Comparison

Traditional American banks:

- Rate: 7.0% – 8.5%

- LTV: 60% – 70%

- Term: 15-30 years

- Fees: 1% – 2%

Specialized banks:

- Rate: 6.5% – 8.0%

- LTV: 65% – 70%

- Term: 15-30 years

- Fees: 0.5% – 1.5%

International banks:

- Rate: 7.5% – 9.0%

- LTV: 50% – 65%

- Term: 15-30 years

- Fees: 1.5% – 2.5%

Optimization Strategies

There are specific strategies to obtain better conditions and increase approval chances.

Financial Preparation

Profile strengthening:

- Larger down payment: Reduces risk and improves rate

- Ample reserves: 6+ months of payments

- Stable income: Consistent history

- Banking relationship: US checking account

Asset structuring:

- Asset concentration: Facilitates verification

- Adequate liquidity: Available resources

- Diversification: Multiple income sources

- Organized documentation: Facilitates analysis

Bank Selection

Selection criteria:

- Specialization: Experience with foreigners

- Conditions: Competitive rates and terms

- Service: Support in your language

- Agility: Efficient process

Multi-bank strategy:

- Simultaneous application: 2-3 banks

- Comparison: Best conditions

- Negotiation: Leverage between offers

- Backup: Alternative options

Timing and Market

Timing factors:

- Interest cycle: Rate trend

- Seasonality: Credit demand

- Regulation: Rule changes

- Economy: Macroeconomic scenario

Financing Alternatives

Besides traditional banks, there are other financing options available.

Private Lenders

Characteristics:

- Flexibility: Less rigid criteria

- Agility: Faster approval

- Customization: Personalized terms

- Cost: Generally higher rates

Types:

- Hard money lenders: Guarantee focus

- Portfolio lenders: Maintain loans

- Bridge lenders: Bridge financing

- Alternative lenders: Alternative criteria

Seller Financing

Specific modality:

- Seller as bank: Directly finances

- Flexibility: Negotiable terms

- Agility: No banking bureaucracy

- Risk: Careful analysis needed

Typical structures:

- Owner carry: Seller carries paper

- Lease option: Rent with purchase option

- Contract for deed: Deed contract

- Wrap-around: Wrap-around financing

Partnerships and Joint Ventures

Corporate structures:

- Partnership with American: Facilitates financing

- Joint venture: Risk sharing

- Structured LLC: Tax optimization

- Trust arrangements: Fiduciary structures

Tax Aspects

Mortgage financing has important tax implications that should be considered.

Interest Deductibility

American rules:

- Mortgage interest deduction: Interest deduction

- Limitations: For non-residents

- Property tax: Tax deduction

- Depreciation: Property depreciation

Tax planning:

- Adequate structuring: LLC vs. individual

- Tax treaties: Avoid double taxation

- Timing: Deduction optimization

- Advisory: Specialized accountant

Impact in Home Country

Foreign obligations:

- Asset declaration: Property and financing

- Foreign income: Reporting requirements

- Capital gains: On sale

- Foreign capital: Reporting requirements

Financing Management

After approval, proper financing management is crucial for investment success.

Payments and Administration

Payment structure:

- American account: For automatic debit

- Remittances: Exchange planning

- Reserves: Contingency fund

- Insurance: Coverage maintenance

Monitoring:

- Statements: Monthly monitoring

- Escrow account: Taxes and insurance

- Principal balance: Balance evolution

- Interest rates: Changes in variable rates

Refinancing

Opportunities:

- Better rates: Cost reduction

- Cash-out: Capital release

- Term change: Term adjustment

- Consolidation: Multiple loans

Ideal timing:

- Interest drop: 1%+ difference

- Profile improvement: Greater assets/income

- Capital need: New investments

- Strategy change: Different objectives

Early Payoff

Considerations:

- Prepayment penalty: Penalties

- Opportunity: Cost vs. return

- Liquidity: Cash flow impact

- Diversification: Risk concentration

Risks and Mitigation

Like any leveraged investment, mortgage financing presents specific risks.

Financial Risks

Interest rate risk:

- Variation: Impact on variable rates

- Refinancing: Future difficulties

- Mitigation: Fixed rate or hedge

- Monitoring: Constant monitoring

Exchange risk:

- Fluctuation: Origin currencies vs. dollar

- Remittances: Variable cost

- Mitigation: Exchange hedge

- Diversification: Dollar income

Operational Risks

Default risk:

- Consequences: Foreclosure

- Prevention: Adequate reserves

- Insurance: Additional protection

- Communication: Dialogue with bank

Regulatory risk:

- Changes: New rules

- Compliance: Constant adequacy

- Advisory: Legal monitoring

- Flexibility: Necessary adaptation

Financing as a Strategic Tool for Investing in Real Estate in Miami

Mortgage financing for foreigners in Miami represents a powerful tool to maximize returns and diversify investments. With the right strategies, organized documentation, and correct choice of institutions, it’s possible to access competitive conditions that significantly enhance purchasing power.

The market continues to evolve favorably for international investors, with banks developing specific products and more efficient processes. The key to success lies in proper preparation, understanding of requirements, and working with professionals experienced in serving foreign clients.

Our specialized team maintains relationships with the main banks and can guide you in choosing the best financing option for your profile and objectives. Contact us for a personalized analysis and discover how financing can enhance your investment in Miami.