Investing in Miami real estate as a foreigner requires deep knowledge of American tax and legal aspects. This comprehensive guide clarifies all tax issues, legal structures and procedures necessary to invest safely with tax optimization.

Investing in Miami real estate as a foreigner offers exceptional opportunities, but requires careful navigation through a complex American tax and legal system. Understanding tax nuances, available legal structures, and compliance requirements is fundamental to maximizing returns and minimizing risks.

This comprehensive guide provides all necessary information for foreign investors to make informed decisions and structure their investments optimally. With adequate knowledge and specialized advice, it’s possible to take advantage of all Miami real estate market benefits while maintaining full legal compliance.

American Tax System for Foreigners

The American tax system has specific rules for foreign investors that differ significantly from those applied to residents.

Tax Classification

Non-Resident Alien (NRA):

- Definition: Foreigner without US tax residency

- Criteria: Less than 183 days per year in the US

- Taxation: Only on US-source income

- Advantages: No taxation on worldwide income

Resident Alien:

- Definition: Foreigner with US tax residency

- Criteria: More than 183 days per year in the US (substantial presence test)

- Taxation: Worldwide income

- Obligations: Mandatory annual filing

Real Estate Taxes

Property Tax (American IPTU):

- Incidence: Annual on assessed value

- Rate: 0.8% to 3% depending on location

- Miami-Dade: Approximately 1.02% annually

- Payment: Semi-annual or annual

- Exemptions: Homestead exemption for primary residence

Rental Income Taxes

For Non-Resident Aliens:

- Rate: 30% on gross income (no deductions)

- Alternative: Election for net taxation with progressive rates

- Deductions: Operating expenses, depreciation, interest

- Filing: Annual Form 1040NR

Practical example:

- Gross income: US$ 60,000/year

- Expenses: US$ 20,000/year

- Net income: US$ 40,000/year

- Tax (30%): US$ 18,000

- Tax (election): US$ 6,000 (15% on net)

FIRPTA (Foreign Investment in Real Property Tax Act)

Mandatory withholding on sale:

- Rate: 15% of sale value

- Application: Automatic for foreign sellers

- Exceptions: Properties below US$ 300,000 for personal use

- Recovery: Through annual filing

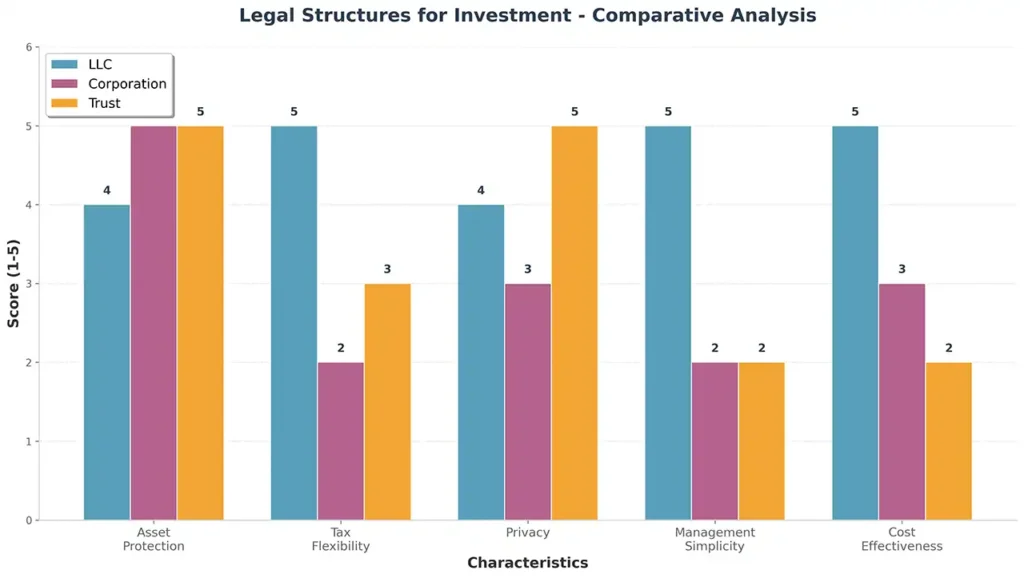

Legal Structures for Investment

Different structures offer specific advantages for foreign investors.

LLC (Limited Liability Company)

Main advantages:

- Asset protection: Separation between personal and business assets

- Tax flexibility: Pass-through taxation

- Privacy: Owners don’t appear in public records

- Management: Simple and flexible structure

Formation process:

- State choice: Delaware, Wyoming, or Florida

- Registered Agent: Mandatory legal representative

- Articles of Organization: Constitutive document

- Operating Agreement: Social contract

- EIN: Tax identification number

Costs involved:

- State fee: US$ 100-500

- Registered Agent: US$ 100-300/year

- Legal advice: US$ 1,500-3,000

- Annual maintenance: US$ 500-1,000

Corporation

Characteristics:

- Taxation: Double taxation (corporation + shareholders)

- Protection: Maximum asset protection

- Complexity: Greater bureaucracy

- Use: Recommended for large investments

Trust

Benefits:

- Estate planning: Efficient transfer

- Privacy: Maximum confidentiality

- Protection: Asset protection

- Complexity: Requires specialized advice

Investor Visas

Different visa categories allow investment and residence in the US.

EB-5 (Investor Visa)

Requirements:

- Investment: US$ 800,000 in rural area or US$ 1,050,000 in other areas

- Jobs: Create 10 direct or indirect jobs

- Term: Permanent green card

- Family: Includes spouse and unmarried children under 21

Process:

- I-526: Initial petition (12-18 months)

- Visa: US entry

- I-829: Condition removal (24 months)

- Citizenship: Eligible after 5 years

E-2 (Treaty Investor)

Requirements:

- Nationality: Treaty country (Brazil included)

- Investment: Substantial (US$ 100,000+)

- Control: 50%+ of company

- Renewal: Indefinite while maintaining investment

L-1 (Intracompany Transfer)

Modalities:

- L-1A: Executives and managers

- L-1B: Specialized knowledge

- Requirements: 1 year working for company abroad

- Duration: 3-7 years depending on category

International Tax Planning

Strategies for legal tax optimization and compliance.

Double Taxation Treaties

Foreign Country-USA:

- Objective: Avoid double taxation

- Benefits: Rate reductions

- Application: Rental income, capital gains

- Procedure: Specific forms (W-8BEN)

Offshore Structuring

Popular jurisdictions:

- Panama: No taxation on external income

- British Virgin Islands: Flexible structure

- Delaware: Corporate advantages

- Wyoming: Privacy and protection

Considerations:

- Compliance: CRS, FATCA

- Economic substance: Growing requirements

- Costs: Maintenance and advice

- Risks: Regulatory changes

Specific Legal Aspects

Particular legal issues of the American real estate market.

Due Diligence

Essential verifications:

- Title search: Property history

- Liens: Encumbrances and liens

- Zoning: Permitted land use

- Environmental: Environmental issues

- HOA: Homeowners association

Real Estate Contracts

Important elements:

- Purchase Agreement: Purchase contract

- Contingencies: Suspensive conditions

- Closing: Closing process

- Title Insurance: Property insurance

- Escrow: Guarantee account

Financing for Foreigners

Credit options available for non-residents.

Foreign National Loans

Characteristics:

- Down payment: 25-40% minimum

- Documentation: Income from country of origin

- Rates: 0.5-1% above residents

- Banks: Bank of America, Wells Fargo, HSBC

Asset-Based Lending

Modality:

- Guarantee: Property itself

- Income: Not required

- Approval: Faster

- Costs: Higher rates

Hard Money Loans

Characteristics:

- Term: Short (6-24 months)

- Approval: Asset-based

- Use: Renovations, flips

- Costs: 8-15% annually

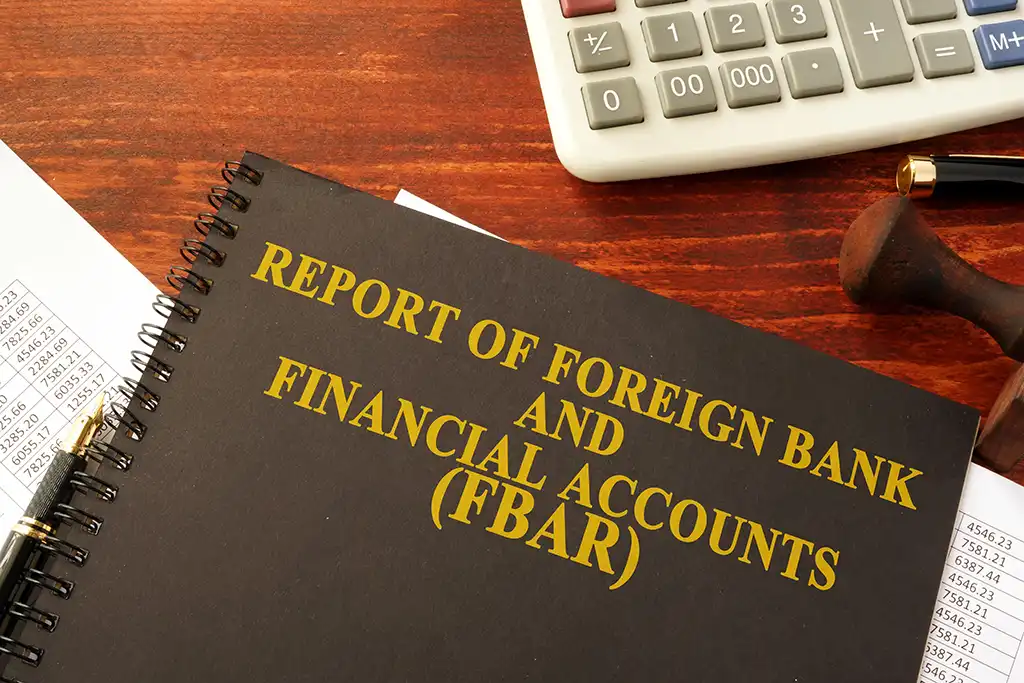

Compliance and Reports

Reporting obligations to American authorities.

FBAR (Foreign Bank Account Report)

Requirements:

- Application: Accounts above US$ 10,000

- Deadline: April 15

- Penalties: Up to US$ 12,921 per account

- Form: FinCEN 114

Form 8938 (FATCA)

Obligations:

- Threshold: US$ 50,000-200,000 depending on status

- Assets: Foreign accounts and investments

- Penalties: US$ 10,000-60,000

- Deadline: With annual filing

Asset Protection

Strategies to protect assets against legal risks.

Asset Protection Trusts

Advantages:

- Protection: Creditors, divorce, lawsuits

- Jurisdictions: Nevada, Delaware, South Dakota

- Structure: Irrevocable

- Costs: US$ 5,000-15,000 for formation

Homestead Exemption

Residence protection:

- Florida: Unlimited protection

- Requirements: Primary residence

- Registration: Declaration with county

- Benefits: Protection against creditors

Multi-Member LLC

Advantages:

- Charging Order: Protection against personal creditors

- Structure: Multiple partners

- Management: Flexible

- Costs: Moderate

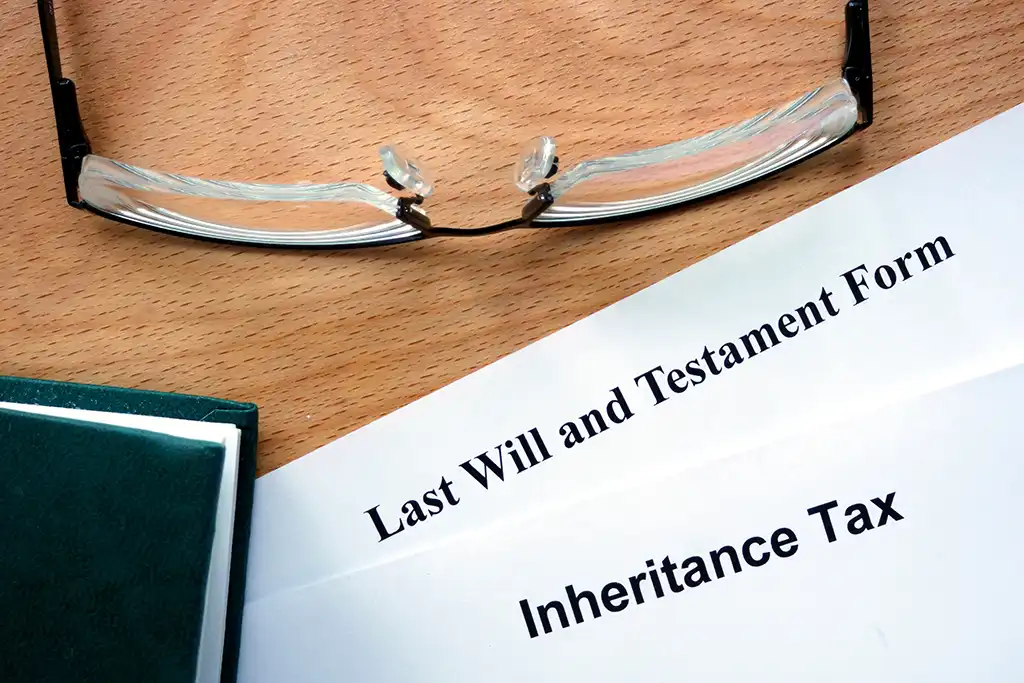

Succession and Inheritance

Planning for asset transfer.

Estate Tax

Characteristics:

- Exemption: US$ 60,000 for foreigners

- Rate: Up to 40%

- Incidence: On US assets

- Planning: Trusts, life insurance

Planning Strategies

Recommended structures:

- Foreign Grantor Trust: Ownership through foreign trust

- Life Insurance: Life insurance for tax payment

- Gifting: Lifetime gifts

- Charitable Remainder Trust: Donations with lifetime income

Advisory Costs

Necessary investment in specialized consulting.

Legal Advisory

Real estate attorney:

- Initial consultation: US$ 300-500

- Due diligence: US$ 1,500-3,000

- Closing: US$ 1,000-2,500

- Structuring: US$ 2,500-7,500

Tax Advisory

Specialized CPA:

- Consultation: US$ 200-400/hour

- Annual filing: US$ 1,500-5,000

- Planning: US$ 2,000-10,000

- Compliance: US$ 1,000-3,000/year

Other Professionals

Additional costs:

- Property Manager: 8-12% of income

- Insurance Agent: Commission included in premium

- Banker: Financing fees

- Wealth Manager: 1-2% of assets

Common Mistakes and How to Avoid Them

Main pitfalls foreign investors should avoid.

Tax Mistakes

Not making tax election:

- Problem: 30% taxation on gross income

- Solution: Form 1040NR with election

- Deadline: First filing

Not reporting FBAR:

- Problem: Severe penalties

- Solution: Annual FinCEN 114

- Deadline: April 15

Structural Mistakes

Poorly structured LLC:

- Problem: Loss of asset protection

- Solution: Adequate Operating Agreement

- Advisory: Specialized attorney

Mixing assets:

- Problem: Piercing the corporate veil

- Solution: Separate accounts, corporate formalities

- Discipline: Treatment as separate entity

Recent Regulatory Changes

Important updates in legislation.

Corporate Transparency Act

Effective: 2024

Requirements:

- Beneficial ownership: Identification of real owners

- Reporting: FinCEN

- Penalties: Up to US$ 10,000 and imprisonment

- Exceptions: Regulated companies

FATCA Enhancements

Improvements:

- Automatic Exchange: Automatic information exchange

- Compliance: Greater oversight

- Penalties: Increased

- Scope: Expanded

Future Opportunities in Real Estate

Expected trends and changes in real estate market.

Digitalization

Blockchain and Real Estate:

- Tokenization: Property fractions

- Smart Contracts: Process automation

- Transparency: Immutable records

- Efficiency: Cost reduction

Tax Changes

Proposals under discussion:

- FIRPTA: Possible rate reductions

- Estate Tax: Exemption changes

- International Tax: Simplification

- Digital Assets: Cryptocurrency regulation

Investing with Legal Security

Navigating the tax and legal aspects of real estate investment in Miami as a foreigner requires specialized knowledge and qualified advice. With adequate structuring and rigorous compliance, it’s possible to maximize returns while minimizing legal and tax risks.

Investment in knowledge and specialized advice is fundamental for long-term success. Saving on consulting can result in much higher costs in the future through fines, unnecessary taxes, or legal problems.

Miami offers a stable and predictable legal environment for international investors. With adequate planning, it’s possible to structure investments that provide legal security, tax optimization, and asset protection.

Our team works with the best attorneys and accountants specialized in international clients. Contact us for a personalized consultation on how to structure your Miami investment in the safest and most efficient way.