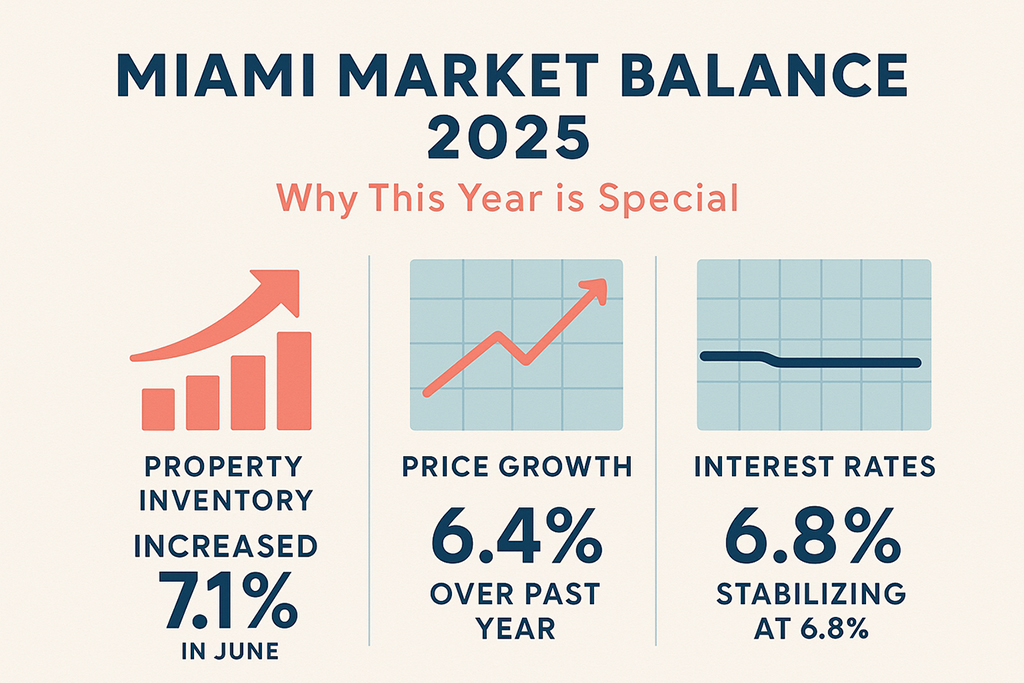

Miami’s real estate market in 2025 presents a unique scenario of opportunities. With inventory growing 7.1%, prices rising in a controlled manner by 6.4%, and interest rates stabilizing, this is the moment investors have been waiting for.

Estimated reading time: 7 minutes

Miami’s real estate market in 2025 is experiencing a historic moment. After years of accelerated growth and volatility, the city has finally found the balance that smart investors have been waiting for. This is the scenario that combines opportunity, stability, and sustainable growth potential.

For international investors dreaming of investing in the United States, Miami has never offered such favorable conditions. The combination of economic, political, and social factors has created a unique window of opportunities that may not repeat anytime soon.

Related Articles

Why 2025 is Special

This year marks a unique moment in Miami’s market. For the first time in a long while, we have a balance between supply and demand that favors both buyers and sellers. The data shows:

- Property inventory increased 7.1% in June, offering more options for buyers

- Prices continue rising in a controlled manner, with 6.4% growth over the past year

- Interest rates, while elevated, are beginning to stabilize around 6.8%

This balance creates the ideal scenario for strategic investments. Unlike previous years when the market was either overheated or stagnant, 2025 offers the stability that serious investors seek.

FACCIN – 25 Years in Miami Real Estate

Buy in Miami with Confidence

Market Fundamentals That Support Growth

Miami’s real estate market is supported by solid fundamentals that ensure sustainable growth.

Economic Diversification

Miami’s economy has never been more diversified:

- Technology: Over 200 tech companies established since 2020

- Finance: Major banks and investment funds relocating headquarters

- International trade: Port of Miami handling record volumes

- Tourism: Full recovery with 17 million annual visitors

This diversification reduces dependence on any single sector and creates sustainable demand for real estate.

Strategic Geographic Position

Miami’s location continues to be its greatest competitive advantage:

- Gateway to Latin America: 60% of US trade with the region

- International flights: Direct connections to 150+ cities

- Time zone: Ideal for business with both Americas and Europe

- Climate: Year-round attraction for residents and tourists

Population Growth

Miami-Dade continues attracting new residents:

- Annual growth: 2.3% (above national average)

- International migration: 45,000 new foreign residents annually

- Domestic migration: 35,000 Americans relocating from other states

- Young demographics: Average age of 38 years

Investment Opportunities by Region

Each Miami region offers distinct opportunities for different investor profiles.

Brickell

- Current situation: Luxury market consolidation

- Opportunity: High-end condos with bay and city views

- Ideal profile: International executives and luxury investors

Why invest now in Brickell:

- New developments with cutting-edge technology

- Walkability and urban lifestyle

- Proximity to financial district

- Proven rental yield of 5-7% annually

- Price range: US$ 600,000 – US$ 3,000,000

- See all developments in Brickell

Downtown Miami

- Current situation: Urban transformation in progress

- Opportunity: Mixed-use properties in revitalization area

- Ideal profile: Long-term investors and young professionals

Why invest now in Downtown Miami:

- Major infrastructure investments underway

- Cultural attractions like museums and theaters

- Government incentives for development

- Appreciation potential above market average

- Price range: US$ 400,000 – US$ 1,500,000

- See all developments in Downtown Miami

Miami Beach

- Current situation: Luxury market stabilization

- Opportunity: Oceanfront properties with appreciation potential

- Ideal profile: High net worth investors

Why invest now in Miami Beach:

- Limited inventory due to construction restrictions

- Constant international demand

- High-season rentals in demand

- Proven historical appreciation

- Price range: US$ 800,000 – US$ 10,000,000+

- See all properties for sale in Miami Beach

Coral Gables

- Current situation: Heated family market

- Opportunity: Family homes in consolidated neighborhood

- Ideal profile: Families and conservative investors

Why invest now in Coral Gables:

- Excellent schools attract families

- Preserved architecture maintains value

- Proximity to business centers

- Established community

- Price range: US$ 600,000 – US$ 3,000,000

- See all properties for sale in Coral Gables

Aventura

- Current situation: Accelerated growth

- Opportunity: Family condos in expanding region

- Ideal profile: Young families and medium-term investors

Why invest now em Aventura:

- Development of new infrastructure

- Still accessible prices compared to other regions

- Growing international community

- High appreciation potential

- Price range: US$ 300,000 – US$ 1,500,000

- See all developments in Aventura

Market Data That Matters

To make intelligent decisions, it’s fundamental to understand the numbers that really move Miami’s market.

Average Prices by Property Type (2025):

- 1-bedroom condos: US$ 450,000 – US$ 650,000

- 2-bedroom condos: US$ 650,000 – US$ 1,200,000

- 3-bedroom condos: US$ 1,200,000 – US$ 2,500,000

- Family homes: US$ 800,000 – US$ 3,000,000

- Luxury mansions: US$ 3,000,000+

Rental Yields by Region:

- Brickell: 5-7% annually

- Downtown: 6-8% annually

- Miami Beach: 4-6% annually

- Coral Gables: 4-5% annually

- Aventura: 5-6% annually

Investment Strategies for 2025

Different strategies work for different investor profiles and objectives.

Strategy 1: Buy and Hold

- Best for: Long-term investors seeking appreciation

- Recommended regions: Coral Gables, Aventura, Pinecrest

- Expected return: 8-12% annually (appreciation + rental)

Advantages:

- Lower risk and predictable returns

- Tax benefits from depreciation

- Passive income from rentals

- Long-term wealth building

Strategy 2: Luxury Investment

- Best for: High net worth investors

- Recommended regions: Miami Beach, Brickell, Key Biscayne

- Expected return: 6-10% annually

Advantages:

- Prestige and lifestyle

- International demand

- Portfolio diversification

- Hedge against inflation

Strategy 3: Value Investment

- Best for: Experienced investors seeking opportunities

- Recommended regions: Downtown, Edgewater, Wynwood

- Expected return: 12-18% annually

Advantages:

- Higher returns potential

- Market inefficiencies

- Gentrification benefits

- Active management opportunities

Financing in 2025

Financing conditions have stabilized, offering more predictability for investors.

Interest Rates

Current scenario:

- 30-year fixed: 6.5-7.2%

- 15-year fixed: 6.0-6.7%

- Adjustable rate: 5.8-6.5%

- Jumbo loans: 6.8-7.5%

Financing for Foreigners

International investors have access to:

- Down payment: 25-30% minimum

- Documentation: Income and asset verification

- Specialized banks: Programs for non-residents

- Competitive rates: Similar to domestic buyers

Market Risks and How to Mitigate Them

Like any investment, Miami real estate has risks that can be mitigated with proper planning.

Identified Risks

Interest Rate Volatility

- Mitigation: Fixed-rate financing and adequate reserves

- Impact: Affects financing costs and demand

Hurricane Season

- Mitigation: Comprehensive insurance and resistant construction

- Impact: Temporary on well-protected properties

Market Oversupply

- Mitigation: Invest in consolidated areas with proven demand

- Impact: Currently low risk due to controlled inventory

Economic Changes

- Mitigation: Diversify by regions and property types

- Impact: Miami’s diversified economy reduces risk

Why Choose Faccin Investments

Our experience and local knowledge make the difference in your investment success.

Competitive advantages:

- 25+ years of Miami market experience

- Multilingual team serving international clients

- Exclusive partnerships with developers and banks

- Complete support from search to closing

Services included:

- Personalized market analysis

- Property selection and evaluation

- Financing assistance

- Complete post-sale support

The Time is Now to invest in Miami real estate

Miami’s real estate market in 2025 offers a rare combination: stability, opportunity, and growth potential. For investors who were waiting for the right moment, that moment has arrived.

Current conditions – balanced inventory, controlled price growth, and sustainable demand – create the ideal scenario for intelligent investments. Whether to live, invest, or diversify assets, Miami has never offered such favorable conditions.

Don’t let this opportunity pass. Miami’s market awaits visionary investors who know how to recognize the right moment. And that moment is now.

Contact us and discover how to take advantage of the best opportunities in Miami’s real estate market in 2025.