Miami’s real estate market shifts to favor buyers with 17.3% sales decline, 31% inventory increase, and potential Fed rate cuts creating strategic opportunities.

Estimated reading time: 13 minutes

Miami’s real estate market is experiencing a significant shift that is creating unprecedented opportunities for strategic buyers and investors. After years of rapid price appreciation and intense competition among purchasers, the market has evolved into a decidedly buyer-friendly environment characterized by increased inventory, extended negotiation periods, and enhanced leverage for well-positioned buyers seeking to enter or expand their presence in one of America’s most dynamic real estate markets.

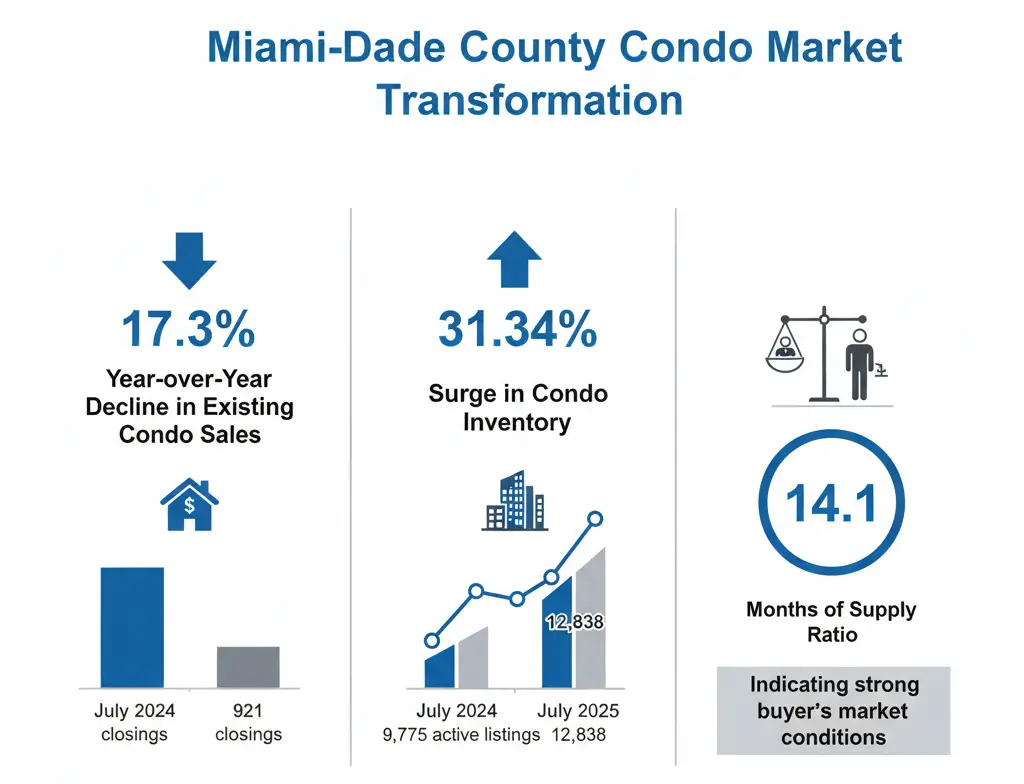

The transformation has been both swift and substantial, with Miami-Dade County’s condominium market experiencing a 17.3% year-over-year decline in existing condo sales during July 2025, falling from 1,114 closings in July 2024 to 921 closings in July 2025. Simultaneously, condo inventory has surged 31.34%, climbing from 9,775 to 12,838 active listings during the same period, creating a months of supply ratio of 14.1 months that firmly establishes current conditions as a strong buyer’s market.

This market recalibration represents more than a temporary adjustment; it reflects a fundamental shift in market dynamics that savvy buyers and investors can leverage to secure exceptional properties at favorable terms. The combination of increased inventory, motivated sellers, and anticipated interest rate reductions creates a convergence of factors that may not persist indefinitely, making the current environment particularly attractive for those prepared to act decisively.

Related Articles

Market Fundamentals Driving the Shift

The current buyer-favorable conditions in Miami’s real estate market result from a complex interplay of economic factors that have collectively shifted the balance of power from sellers to buyers. Elevated mortgage rates, which reached multi-decade highs during 2024, have significantly impacted buyer purchasing power and reduced the pool of qualified purchasers, particularly in the luxury segments where financing often plays a crucial role in transaction completion.

The inventory surge reflects both increased seller motivation and reduced buyer competition. Many property owners who delayed selling during the peak market conditions of 2021-2023 have now entered the market, either due to changing personal circumstances or recognition that current pricing levels may represent optimal selling opportunities. This increased supply, combined with reduced buyer demand due to financing constraints, has created the current buyer-advantaged environment.

The 14.1 months of supply for existing condominiums represents a dramatic shift from the seller’s market conditions that characterized Miami real estate for several years. This supply level provides buyers with extensive options, extended decision-making timeframes, and significant negotiating leverage that was largely absent during the market’s peak activity periods.

The broader economic context also supports current market conditions, with concerns about inflation, employment trends, and global economic stability contributing to buyer caution and seller motivation. These macroeconomic factors have created an environment where patient, well-capitalized buyers can secure exceptional properties at prices and terms that would have been unattainable during peak market conditions.

Economic Impact and Market Implications

The shift in Miami’s real estate market has generated substantial economic implications that extend far beyond individual property transactions. The reduction in total home sales has resulted in a $43.86 million decline in local economic impact, calculated based on the National Association of Realtors’ estimate that each residential transaction generates approximately $129,000 in local economic activity through real estate commissions, mortgage lending, title services, inspections, appraisals, and related consumer spending.

This economic impact reduction affects a broad spectrum of Miami’s real estate-related industries and small businesses, from contractors and movers to interior designers and luxury goods retailers. However, this temporary reduction in transaction volume has created opportunities for buyers to access services and professionals who may have been overextended during peak market periods, potentially resulting in better service levels and more competitive pricing for buyer-related services.

The reduced transaction volume has also created opportunities in related markets, including luxury rentals, where property owners who might have sold during peak conditions are now choosing to retain their properties and generate rental income while waiting for market conditions to improve. This dynamic has strengthened Miami’s luxury rental market while providing additional inventory options for buyers who prefer to rent before purchasing.

The economic implications extend to new construction markets, where developers are increasingly offering incentives, extended closing timelines, and customization options to attract buyers in the more competitive environment. These developer concessions create additional opportunities for buyers seeking new construction properties with enhanced value propositions.

Federal Reserve Policy and Interest Rate Outlook

One of the most significant factors supporting optimism about Miami’s real estate market outlook is the widely anticipated Federal Reserve interest rate policy adjustment. Current market analysis suggests an 88% probability that the Federal Reserve will implement interest rate cuts at its September meeting, with potential additional reductions throughout the remainder of 2025.

The prospect of declining interest rates creates a compelling strategic opportunity for current buyers who can secure properties at favorable prices in the current market environment while potentially benefiting from improved financing costs as rates decline. This combination of favorable purchase conditions and improving financing prospects represents an optimal convergence of market factors for strategic buyers.

Lower interest rates would likely reignite buyer interest and competition, particularly among first-time buyers and move-up purchasers who have been sidelined by affordability concerns. Early movers who secure properties before rate cuts take effect may benefit from both favorable purchase terms and subsequent market appreciation as buyer demand increases.

The interest rate outlook also supports investment strategies focused on cash-flow positive properties, as lower financing costs improve rental property economics and make leveraged investment strategies more attractive. International buyers, who often rely less heavily on financing, may find the current environment particularly advantageous for building or expanding their Miami real estate portfolios.

The timing of potential rate cuts adds urgency to current market opportunities, as the window for securing properties under current buyer-favorable conditions may close relatively quickly once financing costs decline and buyer competition intensifies.

Strategic Opportunities Across Property Types

The current market environment has created strategic opportunities across multiple property types and price segments, each offering distinct advantages for different buyer profiles and investment objectives. The luxury condominium market, which has experienced the most significant inventory increases, presents particularly compelling opportunities for buyers seeking high-end properties with premium amenities and prime locations.

New construction condominiums offer especially attractive opportunities, with developers increasingly willing to negotiate on pricing, provide upgrade allowances, and offer extended closing timelines that accommodate buyer financing and planning needs. Many developers are also providing rental guarantees or management services that enhance the investment appeal of new construction purchases.

Pre-construction opportunities have become particularly attractive as developers seek to maintain sales momentum in a more challenging environment. These purchases often provide the greatest customization opportunities while potentially offering the best value propositions as developers balance current market realities with future delivery obligations.

The single-family home market, while less affected by inventory increases than the condominium segment, still offers opportunities for strategic buyers, particularly in neighborhoods where sellers are motivated by relocation needs or changing life circumstances. Waterfront properties, which typically maintain strong demand even in buyer’s markets, may offer negotiation opportunities that were unavailable during peak market conditions.

The luxury rental market has also strengthened as a result of current sales market conditions, creating opportunities for investors to acquire properties with strong rental potential while benefiting from favorable purchase terms. The combination of reduced purchase prices and strong rental demand creates attractive cash-flow scenarios for investment-focused buyers.

Negotiation Strategies and Buyer Advantages

The current market environment provides buyers with negotiation leverage that has been largely absent from Miami’s real estate market for several years. Sellers facing extended marketing periods and increased competition are increasingly willing to consider price reductions, closing cost contributions, and other concessions that enhance the overall value proposition for buyers.

FACCIN – 25 Years in Miami Real Estate

Buy in Miami with Confidence

Successful negotiation strategies in the current environment focus on demonstrating buyer readiness and financial capability while leveraging market conditions to secure favorable terms. Pre-approved financing, proof of funds, and flexible closing timelines can provide significant advantages in negotiations, particularly when combined with realistic but competitive offers that reflect current market conditions.

The extended inventory levels allow buyers to be more selective and patient in their property search, avoiding the pressure to make immediate decisions that characterized peak market periods. This extended decision-making timeframe enables more thorough due diligence, property comparisons, and strategic planning that can result in better long-term investment outcomes.

Buyers can also leverage the current environment to secure properties with superior locations, amenities, or architectural features that might have been prohibitively competitive during peak market conditions. The reduced buyer competition creates opportunities to acquire exceptional properties that represent long-term value even if purchased during a market downturn.

The current environment also favors buyers seeking to consolidate or upgrade their real estate holdings, as the combination of favorable purchase conditions and potential selling opportunities creates scenarios where strategic portfolio adjustments can be accomplished with enhanced economic benefits.

International Buyer Opportunities

International buyers, who represent a significant portion of Miami’s luxury real estate market, may find the current environment particularly advantageous for several reasons. The reduced domestic buyer competition creates opportunities for international purchasers to secure prime properties without the intense bidding wars that characterized recent peak periods.

Currency considerations also play a role in international buyer opportunities, as favorable exchange rates combined with reduced property prices can create exceptional value propositions for buyers from countries with strong currencies relative to the U.S. dollar. These currency advantages, combined with market conditions, may create optimal purchasing opportunities for international investors.

The extended inventory levels provide international buyers with more time to conduct thorough property evaluations, arrange financing, and complete the complex legal and tax planning that often accompanies international real estate transactions. This extended timeframe reduces the pressure for immediate decisions and allows for more strategic planning and execution.

International buyers also benefit from the current environment’s impact on related services, including legal, tax, and property management services that may be more available and competitively priced during periods of reduced transaction volume. These service improvements can enhance the overall international buying experience while potentially reducing transaction costs.

The combination of favorable purchase conditions and Miami’s continued appeal as an international destination creates compelling opportunities for international buyers to establish or expand their U.S. real estate presence while market conditions remain buyer-favorable.

Investment Analysis and Return Potential

From an investment perspective, the current Miami real estate market presents opportunities that combine favorable acquisition costs with strong long-term appreciation potential. The temporary market softening has created entry points for investment properties that may generate superior returns as market conditions normalize and appreciation resumes.

The rental market strength provides immediate cash-flow opportunities for investment buyers, with many properties offering positive cash flow scenarios that were difficult to achieve during peak purchase price periods. This rental income potential provides downside protection while investors await long-term appreciation benefits.

The anticipated interest rate reductions support optimistic long-term return projections, as lower financing costs typically stimulate buyer demand and support property value appreciation. Investors who secure properties during current market conditions may benefit from both favorable acquisition terms and subsequent market appreciation as conditions improve.

The international buyer demand that has driven much of Miami’s recent growth remains intact, providing fundamental support for long-term investment returns. The temporary reduction in buyer competition does not reflect reduced international interest in Miami real estate, but rather timing and financing considerations that are likely to resolve as market conditions improve.

Value-add opportunities have also increased in the current environment, as sellers of properties requiring renovation or updating may be more motivated to negotiate favorable terms. These opportunities allow investors to acquire properties below replacement cost while adding value through strategic improvements.

Timing Considerations and Market Outlook

The timing aspects of current market opportunities add urgency to buyer decision-making, as the convergence of favorable conditions may not persist indefinitely. The anticipated Federal Reserve rate cuts could quickly shift market dynamics back toward seller-favorable conditions, particularly in Miami’s luxury segments where international demand remains strong.

The seasonal patterns of Miami’s real estate market also support current timing considerations, as the approaching fall and winter seasons typically bring increased buyer activity from both domestic and international purchasers seeking to establish Miami residences before the peak season begins.

The new construction delivery schedule adds another timing consideration, as many projects scheduled for completion in 2025 and 2026 were pre-sold during peak market conditions. The completion of these projects may reduce new construction inventory while potentially increasing resale inventory as investors and speculators seek to realize profits from their pre-construction purchases.

The broader economic outlook supports optimistic medium-term projections for Miami real estate, with the city’s continued growth as an international financial center, expanding technology sector, and strengthening cultural amenities providing fundamental support for long-term property value appreciation.

Market participants who can act decisively in the current environment may benefit from optimal timing that combines favorable acquisition conditions with positive long-term market fundamentals.

Professional Guidance and Transaction Management

The complexity of navigating current market conditions makes professional guidance particularly valuable for buyers seeking to optimize their real estate transactions. Experienced real estate professionals who understand current market dynamics can provide crucial insights into pricing strategies, negotiation tactics, and timing considerations that maximize buyer advantages.

The current environment also benefits from specialized financing expertise, as lenders adapt their programs and requirements to current market conditions. Buyers who work with experienced mortgage professionals may access financing options and terms that enhance their purchasing power and transaction flexibility.

Legal and tax considerations become particularly important in the current environment, as buyers seek to structure transactions that optimize their financial benefits while protecting their interests in a changing market. Professional legal and tax guidance can help buyers navigate these complexities while maximizing their strategic advantages.

Property management and investment analysis services also provide value in the current environment, helping buyers evaluate rental potential, cash-flow projections, and long-term investment scenarios that inform their purchase decisions and post-acquisition strategies.

The coordination of these professional services becomes crucial for buyers seeking to move quickly and decisively when optimal opportunities arise in the current market environment.

Miami Real Estate Transformation into a Buyer’s Market

Miami’s transformation into a buyer’s market represents a significant opportunity for strategic purchasers and investors who can recognize and act upon the favorable conditions that have emerged. The 17.3% decline in condo sales, combined with the 31% increase in inventory and anticipated Federal Reserve rate cuts, creates a convergence of factors that may not persist indefinitely.

The current environment rewards buyers who can move decisively while maintaining strategic focus on long-term value and investment potential. The combination of reduced competition, motivated sellers, and improving financing prospects creates opportunities to secure exceptional properties at favorable terms while positioning for future appreciation as market conditions normalize.

The international appeal of Miami real estate remains intact, providing fundamental support for long-term investment returns even as short-term market dynamics favor buyers. The city’s continued evolution as a global financial and cultural center ensures that current market softening represents a temporary adjustment rather than a fundamental change in Miami’s real estate trajectory.

For buyers and investors prepared to act strategically in the current environment, Miami’s real estate market offers opportunities that combine immediate advantages with strong long-term potential. The key to success lies in recognizing that current conditions represent an optimal convergence of factors that favor well-positioned buyers who can move decisively when exceptional opportunities arise.

The window for maximizing these buyer advantages may close relatively quickly as interest rates decline and buyer competition intensifies. Those who can act now may find themselves optimally positioned to benefit from both current market conditions and future appreciation as Miami continues its evolution as one of America’s premier real estate destinations.