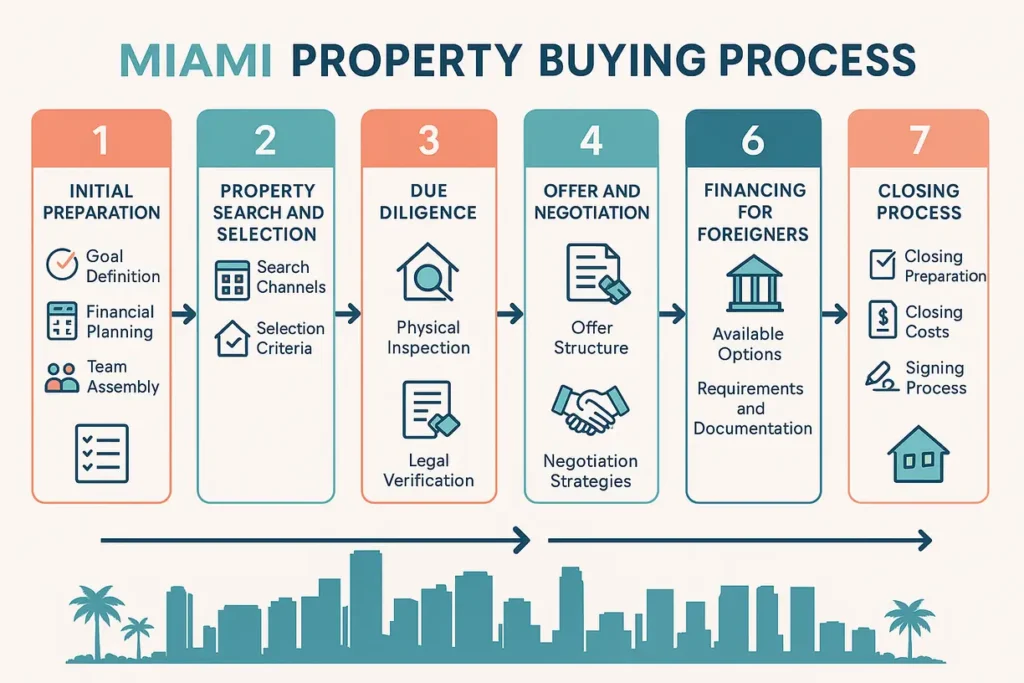

Buying property in Miami can be a simple and secure process for foreigners when you understand each step of the journey. This detailed guide explains everything from initial search to closing, including legal, financial, and practical aspects specific to international investors.

Miami’s real estate market is one of the most accessible in the world for foreign buyers, with streamlined processes and solid legal protections. Unlike many countries that impose severe restrictions on property acquisition by non-residents, the United States – particularly Florida – offers a welcoming environment for international investors.

This comprehensive guide details each step of the buying process in Miami, from initial preparation to final closing, focusing on particularities relevant to foreigners. With this information, you’ll be able to navigate the local real estate market with confidence, avoiding common pitfalls and maximizing your investment.

Initial Preparation

Before starting your property search, it’s essential to establish solid foundations for the buying process.

Goal Definition

Purchase purpose:

- Investment: Focus on financial return

- Personal use: Second home or vacation

- Mixed: Personal use with rental periods

- Immigration: Part of relocation strategy

Investment horizon:

- Short term: 1-3 years (flip)

- Medium term: 3-7 years

- Long term: 7+ years (wealth building)

Financial Planning

Total budget:

- Property price: Main value

- Acquisition costs: 3-6% of value

- Contingency reserve: Additional 5-10%

- Operating costs: Annual maintenance

Financial structuring:

- Own resources: Cash percentage

- Financing: Available options

- Exchange: Remittance strategy

- Taxes: Tax planning

Team Assembly

Essential professionals:

- Realtor: Licensed Florida broker

- Attorney: Real estate specialist

- Accountant: Familiar with US-international taxation

- Inspector: Certified professional

Selection criteria:

- Experience: With foreign clients

- Language: Fluency in your language

- References: Proven track record

- Transparency: Clear commission structure

Property Search and Selection

The search process in Miami can be conducted remotely or in person, with specific tools and strategies.

Search Channels

Online platforms:

- MLS: Official Multiple Listing Service

- Zillow/Realtor.com: Popular aggregators

- Developer websites: Direct launches

- Specialized portals: Focus on international buyers

In-person search:

- Real estate tour: Organized visits

- Open houses: Public viewings

- Networking: Personal referrals

- Exclusive brokers: Buyer’s agent

Selection Criteria

Location:

- Neighborhood: Profile and appreciation

- Proximity: Services and amenities

- Access: Transportation and connectivity

- Safety: Crime rates

Property characteristics:

- Typology: Apartment, house, townhouse

- Size: Square footage and configuration

- Age: New vs. used

- Amenities: Condominium services

Financial potential:

- Historical appreciation: Data from recent years

- Rental potential: Expected yield

- Operating costs: HOA and taxes

- Liquidity: Ease of resale

Due Diligence

Detailed property investigation is crucial to avoid unpleasant surprises after purchase.

Physical Inspection

Structural elements:

- Foundation: Stability and integrity

- Roof/coverage: Condition and lifespan

- Electrical systems: Code compliance

- Plumbing: Conditions and materials

Florida-specific elements:

- Hurricane protection: Windows and doors

- Air conditioning system: Efficiency

- Termite treatment: Certificates

- Mold: Specialized inspection

Legal Verification

Property documentation:

- Property title: Clarity and restrictions

- Liens: Mortgages and attachments

- Disputes: Pending litigation

- Zoning: Usage permissions

Condominium documentation:

- Rules: HOA regulations

- Financial: Condominium financial health

- Reserves: Maintenance funds

- Restrictions: Rental limitations

Offer and Negotiation

Presenting an offer is a formal and legally binding step in the buying process.

Offer Structure

Essential elements:

- Price: Proposed value

- Earnest money: Initial deposit (1-5%)

- Financing: Conditions or proof of funds

- Timeline: Timeline for closing

- Contingencies: Conditions for effectiveness

Common contingencies:

- Inspection: Approval of inspection

- Financing: Loan approval

- Appraisal: Value compatible with financing

- Title: Absence of legal problems

Negotiation Strategies

Effective approaches:

- Comparative data: Prices of similar properties

- Time on market: Properties listed longer

- Seller conditions: Specific motivations

- Flexibility: Terms beyond price

Mistakes to avoid:

- Emotion: Decisions based on feelings

- Rush: Negligence in due diligence

- Inflexibility: Focus only on price

- Ignorance: Ignoring local practices

Purchase and Sale Contract

The contract (Purchase and Sale Agreement) is the legal document that formalizes the transaction.

Contractual Elements

Essential clauses:

- Identification: Parties and property

- Price and payment: Values and schedule

- Contingencies: Suspensive conditions

- Deadlines: Dates for each step

- Penalties: Consequences for non-compliance

Buyer protections:

- Inspection period: Deadline for withdrawal

- Escrow: Deposit protection

- Disclosure: Problem revelation

- Default: Remedies in case of seller failure

Legal Review

Importance of legal analysis:

- Translation: Complete understanding in your language

- Customization: Adaptation to needs

- Risks: Vulnerability identification

- Negotiation: Necessary contractual adjustments

Financing for Foreigners

Although more restricted than for residents, viable financing options exist for foreigners.

Available Options

American banks:

- Non-resident programs: 50-65% financing

- Rates: Generally 1-2% above local market

- Documentation: More extensive than for residents

- Term: 15-30 years

International banks:

- Global banks with US operations: HSBC, Santander

- Banks from your country with US presence

- Advantage: Banking history considered

- Disadvantage: Potentially higher rates

Requirements and Documentation

Personal documents:

- Passport: Main identification

- ITIN: American fiscal number

- Proof of residence: In country of origin

- Banking history: 3-6 months of statements

Financial documents:

- Income verification: Tax returns

- Assets: Assets and investments

- Credit history: International when available

- Bank references: Relationship letters

Closing Process

Closing is the final stage where property is effectively transferred.

Closing Preparation

Final documentation:

- Closing disclosure: Cost breakdown

- Deed: Transfer deed

- Bill of sale: For included movable items

- Affidavits: Sworn statements

Final inspection:

- Walk-through: 24-48h before closing

- Verification: Conditions as per contract

- Repairs: Completion confirmation

- Systems: Functionality test

Closing Costs

Buyer expenses:

- Title insurance: 0.5-1% of value

- Doc stamps: State tax on documents

- Recording fees: Registry fees

- Escrow fees: Escrow agent fees

- HOA/Condo fees: Pro-rata fees

Additional costs:

- Inspection: US$ 300-600

- Appraisal: US$ 400-700

- Attorney: US$ 1,500-3,000

- Home insurance: First year in advance

Signing Process

Closing options:

- In-person: At title company or office

- Remote: Via power of attorney

- Mail-away closing: Documents sent

- RON: Remote Online Notarization (new)

Signed documents:

- HUD-1/Closing statement: Financial summary

- Deed: Property transfer

- Mortgage: Financing documents

- Affidavits: Various declarations

Property Structuring

The form of property ownership has important legal and tax implications.

Ownership Options

Individual:

- Individual: Single owner

- Joint tenancy: Co-ownership with right of survivorship

- Tenancy in common: Co-ownership without automatic right

Legal entity:

- American LLC: Limited Liability Company

- Offshore LLC: International structure

- Corporation: S-Corp or C-Corp

- Trust: Fiduciary structure

Tax Considerations

Income tax:

- FIRPTA: Withholding on sale (15%)

- Annual declaration: Mandatory

- Tax treaties: Avoid double taxation

- Estate tax: Inheritance tax

Local taxes:

- Property tax: Property tax

- Homestead exemption: Not applicable to non-residents

- Intangible tax: On financial assets

- Sales tax: In case of short-term rental

Post-Acquisition

After purchase, various practical aspects need to be managed, especially by non-resident owners.

Property Management

Management options:

- Property manager: Complete management

- Condominium: Limited services

- Concierge: Personalized services

- Self-management: Own management

Typical services:

- Maintenance: Preventive and corrective

- Payments: Bills and taxes

- Inspections: Periodic inspections

- Emergencies: 24h service

Property Rental

Modalities:

- Long term: Annual contracts

- Seasonal: 1-6 months

- Short term: Airbnb, VRBO (check restrictions)

- Corporate: Executives and companies

Legal considerations:

- Licenses: Municipal requirements

- Taxes: Sales tax and bed tax

- Restrictions: HOA and zoning

- Insurance: Adequate coverage

Ongoing Tax Obligations

Mandatory declarations:

- Income tax return: Form 1040NR

- FBAR: Bank account declaration

- FIRPTA: Withholding on sale

- FinCEN: Foreign asset declaration

Important deadlines:

- Property tax: Payment by November 30

- Income tax: Declaration by April 15

- FBAR: Submission by April 15

- Extensions: Possibility of extension

Selling Process

When the time comes to sell, there are specific considerations for foreign sellers.

Sale Preparation

Property optimization:

- Staging: Decoration for sale

- Repairs: Problem correction

- Curb appeal: First impression

- Documentation: Record organization

Pricing strategy:

- CMA: Comparative Market Analysis

- Trends: Market direction

- Seasonality: Ideal timing

- Flexibility: Negotiation margin

Tax Aspects of Sale

FIRPTA (Foreign Investment in Real Property Tax Act):

- Withholding: 15% of gross sale value

- Exceptions: Properties below US$ 300,000 with residential use

- Reduced withholding certificate: Form 8288-B

- Tax return: Final declaration for refund

Capital gain:

- Calculation: Sale price minus adjusted basis

- Rate: 15-20% federal + state

- Deductible expenses: Improvements, selling costs

- 1031 Exchange: Tax deferral

Tips and Best Practices

Recommendations based on the experience of thousands of foreign buyers in Miami.

Common Mistakes to Avoid

Frequent pitfalls:

- Skipping due diligence: Saving on inspection

- Ignoring HOA: Not analyzing rules and finances

- Underestimating costs: Incomplete budget

- Neglecting taxes: Ignoring obligations

Florida-specific issues:

- Insurance: Growing difficulties

- Climate: Hurricane and flood risks

- Construction: Variable quality

- Regulation: Frequent changes

Success Strategies

Proven approaches:

- Prior education: Market knowledge

- Qualified team: Experienced professionals

- Patience: Unhurried process

- Long-term vision: Realistic perspective

Specific opportunities:

- Distressed properties: Discounted properties

- Off-market: Unlisted properties

- Pre-construction: Off-plan launches

- Emerging areas: Developing neighborhoods

Safe Investment with Proper Knowledge

The process of buying property in Miami for foreigners is accessible and safe when conducted with proper knowledge and correct professional support. Although there are important particularities, the American system was developed to offer transparency and protection to all buyers, regardless of nationality.

By following the detailed steps in this guide and relying on experienced professionals, you can navigate the Miami real estate market with confidence, avoiding common pitfalls and maximizing your investment. The result will be not only the acquisition of a valuable property but also a smooth and positive experience.

Our team specializing in serving international investors is ready to guide you through each step of this process, from initial search to post-acquisition management. Contact us for a personalized consultation and discover how we can make your Miami investment a simple and safe reality.