Latin American investors dominate Miami real estate with 49% of new construction sales, led by Colombia’s 39-month search leadership and Argentina’s buying power.

Estimated reading time: 13 minutes

Miami’s transformation into a global real estate powerhouse has been significantly fueled by an unprecedented surge in Latin American investment, with recent data revealing that international buyers now account for nearly half of all new construction sales in the South Florida market. This remarkable trend reflects not only Miami’s growing appeal as an investment destination but also the city’s unique position as the de facto capital of Latin America for real estate investment.

The latest comprehensive analysis of Miami’s new construction market shows that 49% of all new construction, pre-construction, and condo conversion sales over an 18-month period ending in June 2025 were purchased by international buyers. This figure, derived from data encompassing 9,115 units across 37 new construction condominium projects in the Miami market area, represents one of the highest concentrations of foreign investment in any major U.S. real estate market.

The dominance of Latin American buyers in Miami’s real estate landscape reflects a complex interplay of economic, political, and cultural factors that have made South Florida the preferred destination for wealthy individuals and families seeking to diversify their assets and establish a presence in the United States. This trend has created a self-reinforcing cycle of growth, infrastructure development, and cultural enrichment that continues to attract new waves of international investment.

Related Articles

Colombia Leads Global Search Interest for 39 Consecutive Months

In a remarkable demonstration of sustained interest, Colombia has maintained its position as the leading country in global web searches for South Florida real estate for 39 consecutive months, representing more than three years of consistent market leadership. This extraordinary streak underscores the deep and enduring interest among Colombian investors in Miami real estate opportunities.

Colombia’s dominance in search activity translates to tangible market impact, with Colombian buyers representing 13.3% of all international searches for Miami real estate in June 2025. This sustained interest reflects several key factors that make Miami particularly attractive to Colombian investors: political stability concerns in their home country, favorable exchange rates, Miami’s established Colombian community, and the city’s reputation as a secure haven for international capital.

The consistency of Colombian interest is particularly noteworthy given the volatile political and economic landscape in Latin America over the past three years. While other countries have experienced fluctuations in their search activity based on domestic conditions, Colombia’s steady presence in Miami’s market demonstrates a fundamental shift in how wealthy Colombians view international real estate investment as an essential component of their wealth preservation strategy.

Beyond search activity, Colombian buyers have established a significant physical presence in Miami’s luxury developments. Many of the city’s most prestigious new construction projects report substantial Colombian buyer participation, with some developments seeing Colombian purchasers account for 20% or more of their total sales. This concentration has created vibrant Colombian communities within specific Miami neighborhoods, further attracting additional investment from Colombia.

Argentina Emerges as Top International Buyer in 2024

While Colombia leads in search activity, Argentina has established itself as the most significant international buyer by transaction volume, accounting for 18% of all international purchases in South Florida during 2024. This leadership position reflects the substantial purchasing power of Argentine buyers and their preference for Miami real estate as a hedge against domestic economic uncertainty.

The Argentine buyer profile in Miami typically involves high-net-worth individuals and families seeking to preserve wealth outside their home country’s volatile economic environment. These buyers often purchase multiple properties, including primary residences, investment properties, and vacation homes, creating a diversified Miami real estate portfolio that serves multiple purposes.

Argentine investment patterns show a strong preference for luxury condominiums in prime locations such as Brickell, Miami Beach, and Coral Gables. These buyers typically favor new construction projects that offer modern amenities, professional property management, and the potential for rental income when the properties are not in personal use. The ability to generate U.S. dollar-denominated rental income has become particularly attractive to Argentine investors dealing with currency devaluation concerns in their home market.

The Argentine presence in Miami extends beyond individual property purchases to include significant commercial real estate investment. Argentine business leaders have established Miami offices, invested in local businesses, and created employment opportunities that further strengthen the economic ties between Argentina and South Florida. This business investment creates additional demand for residential real estate as Argentine executives and employees relocate to Miami.

Comprehensive Latin American Market Participation

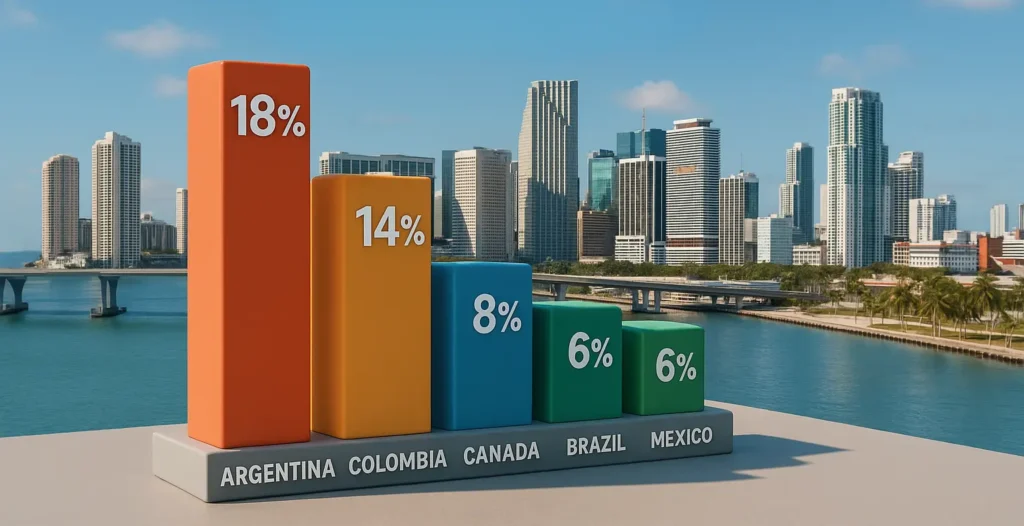

The top five international buyer countries in Miami’s 2024 market paint a picture of comprehensive Latin American participation: Argentina (18%), Colombia (14%), Canada (8%), Brazil (6%), and Mexico (6%). This distribution demonstrates that Miami’s appeal extends across the entire Latin American region, with each country bringing distinct investment patterns and preferences.

Brazilian buyers, despite representing a smaller percentage of total transactions, typically make larger individual purchases and show strong preferences for luxury waterfront properties. The Brazilian community in Miami has established sophisticated support networks, including specialized legal, financial, and real estate services that cater specifically to Brazilian buyers’ needs. This infrastructure has made Miami increasingly accessible to Brazilian investors who might otherwise find the U.S. real estate market challenging to navigate.

Mexican buyers have shown particular interest in Miami’s business district developments, reflecting the growing economic ties between Mexico and South Florida. Many Mexican business leaders view Miami as an ideal location for establishing U.S. operations while maintaining close proximity to their home country. This business-driven demand has created steady interest in both residential and commercial real estate opportunities.

The Canadian presence in Miami’s international buyer market represents a different dynamic, with many Canadian buyers seeking escape from harsh winters and high tax burdens. Canadian investment tends to be more seasonal and lifestyle-driven, though the volume and consistency of Canadian purchases make them a significant market force.

The “Money Goes North” Phenomenon

Miami Chairman of the Board Eddie Blanco’s observation that “when Latin American governments go left, money goes north” captures a fundamental driver of Miami’s international real estate boom. This phenomenon reflects the tendency of wealthy Latin Americans to seek asset diversification and political stability when their home countries experience political shifts toward more interventionist economic policies.

This pattern has been particularly evident in recent years as several major Latin American countries have elected governments with more socialist or populist orientations. Wealthy individuals and families in these countries often respond by accelerating their international investment activities, with Miami serving as the primary beneficiary due to its proximity, cultural familiarity, and established Latin American communities.

The political risk mitigation aspect of Miami real estate investment cannot be understated. For many Latin American buyers, Miami properties represent more than investment opportunities; they serve as insurance policies against potential political or economic instability in their home countries. This perspective creates a buyer base that is less sensitive to short-term market fluctuations and more focused on long-term wealth preservation.

The cultural comfort factor also plays a crucial role in Miami’s appeal to Latin American buyers. The city’s bilingual environment, established Latin American business networks, and cultural institutions create an atmosphere where international buyers can conduct business and live comfortably without the cultural adjustment challenges they might face in other U.S. markets.

Global Search Patterns and Market Intelligence

The geographic distribution of international searches for Miami real estate provides valuable insights into future market trends and buyer behavior. The top 10 international cities searching Miami real estate in June 2025 were: Bogotá, Colombia; Dublin, Ireland; Madrid, Spain; Buenos Aires, Argentina; Medellín, Colombia; Toronto, Canada; Moscow, Russia; Cairo, Egypt; São Paulo, Brazil; and London, England.

This diverse geographic representation demonstrates Miami’s truly global appeal, extending far beyond its traditional Latin American buyer base. The presence of European cities like Madrid, Dublin, and London in the top 10 reflects Miami’s growing recognition as an international financial center and lifestyle destination that competes with traditional European luxury markets.

The inclusion of cities like Moscow and Cairo indicates Miami’s appeal to buyers from regions experiencing political or economic uncertainty. These markets represent potential growth opportunities for Miami real estate as global wealth seeks stable, liquid investment opportunities in politically secure jurisdictions.

The strong representation of Colombian cities (Bogotá and Medellín) in the top 10 reinforces Colombia’s position as Miami’s most engaged international market. The fact that two Colombian cities appear in the global top 10 demonstrates the depth and breadth of Colombian interest in Miami real estate opportunities.

Investment Patterns and Buyer Preferences

Latin American buyers in Miami exhibit distinct investment patterns that reflect their unique needs and objectives. Unlike domestic buyers who may focus primarily on personal use or traditional investment returns, international buyers often seek properties that serve multiple purposes: wealth preservation, lifestyle enhancement, business facilitation, and family security.

New construction properties have proven particularly attractive to Latin American buyers for several reasons. These properties offer modern amenities and building systems that meet international standards, professional property management that can handle absentee ownership, and the potential for customization during the construction process. Additionally, new construction often provides better financing options for international buyers and clearer title situations that simplify the purchase process.

The preference for luxury amenities among Latin American buyers has driven developers to create increasingly sophisticated residential offerings. Many new Miami developments now feature amenities that rival five-star resorts: private marinas, helicopter pads, spa facilities, private dining rooms, and concierge services. These amenities cater specifically to the expectations of ultra-wealthy international buyers who are accustomed to luxury service levels in their home countries.

Location preferences among Latin American buyers show strong clustering in specific Miami neighborhoods that offer the best combination of luxury, security, and international community. Brickell has become particularly popular due to its modern high-rise developments, proximity to the financial district, and established international resident base. Miami Beach attracts buyers seeking luxury lifestyle amenities and oceanfront access, while Coral Gables appeals to families seeking prestigious residential neighborhoods with excellent schools.

Economic Impact and Market Transformation

The influx of Latin American investment has fundamentally transformed Miami’s real estate market and broader economy. International buyers bring not only purchase capital but also ongoing economic activity through property maintenance, local spending, business investment, and employment creation. This multiplier effect extends far beyond the initial real estate transaction to create sustained economic benefits for the South Florida region.

The presence of wealthy international residents has attracted luxury service providers, high-end retailers, and cultural institutions that enhance Miami’s appeal to both residents and visitors. This infrastructure development creates a positive feedback loop that attracts additional international investment and further strengthens Miami’s position as a global city.

The international buyer presence has also influenced Miami’s development patterns, with developers increasingly designing projects to meet international buyer preferences and standards. This has resulted in higher-quality construction, more sophisticated amenities, and better property management standards that benefit all Miami residents.

The economic impact extends to related industries including legal services, banking, wealth management, and luxury goods retail. Miami has developed specialized service sectors that cater specifically to international clients, creating employment opportunities and establishing the city as a regional hub for international business services.

Future Market Outlook and Opportunities

The sustained growth in Latin American investment suggests continued strength in Miami’s international real estate market. Several factors support optimistic projections for continued growth: ongoing political and economic uncertainty in key Latin American markets, Miami’s expanding role as a regional financial center, continued infrastructure development, and the city’s growing reputation as a global luxury destination.

Emerging opportunities exist across multiple property types and price points. While ultra-luxury properties garner significant attention, substantial opportunities exist in the mid-luxury segment where international buyers seek properties for extended family members, business associates, or rental investment purposes. These buyers often purchase multiple units within the same development or neighborhood, creating concentrated international communities.

The pre-construction market continues to offer attractive opportunities for international buyers who appreciate the ability to customize their properties and potentially benefit from appreciation during the construction period. Many developers now structure their sales processes specifically to accommodate international buyers, offering extended closing timelines, currency hedging options, and specialized financing arrangements.

The rental market for international-owned properties has shown remarkable strength, with many owners able to generate substantial rental income from their Miami properties when not in personal use. This income potential adds another dimension to the investment case for Miami real estate, particularly for international buyers who may use their properties seasonally or maintain them as investment assets.

Strategic Considerations for International Buyers

Prospective international buyers should consider several strategic factors when evaluating Miami real estate opportunities. The importance of working with experienced professionals who understand international transactions cannot be overstated. These transactions often involve complex legal structures, tax considerations, and financing arrangements that require specialized expertise.

Currency considerations play a crucial role in international real estate investment decisions. Many Latin American buyers benefit from purchasing Miami real estate when their home currencies are strong relative to the U.S. dollar, though the long-term wealth preservation benefits often outweigh short-term currency fluctuations.

The legal and tax implications of international real estate ownership require careful planning and professional guidance. International buyers must navigate U.S. tax obligations, reporting requirements, and estate planning considerations that can significantly impact the overall investment returns and family wealth transfer strategies.

Explore exclusive new construction opportunities

Miami Offers a Unique Combination for Latin American Investors

The dominance of Latin American buyers in Miami’s real estate market represents more than a statistical trend; it reflects Miami’s successful evolution into a truly global city that serves as the financial and cultural capital of Latin America. The 49% international buyer participation in new construction sales demonstrates the depth and sustainability of this market transformation.

For Latin American investors, Miami offers a unique combination of political stability, economic opportunity, cultural familiarity, and lifestyle enhancement that is difficult to replicate in other international markets. The city’s continued infrastructure development, expanding business opportunities, and growing international community create a compelling case for sustained investment growth.

The 39-month leadership by Colombia in search activity and Argentina’s position as the top buyer by volume illustrate the diverse ways that Latin American countries engage with Miami’s real estate market. This diversity provides stability and growth potential as different countries contribute to market demand based on their unique economic and political cycles.

As Miami continues to develop its position as a global financial center and luxury destination, the opportunities for international buyers will likely expand and evolve. The city’s proven track record of accommodating international investment, combined with its strategic location and business-friendly environment, positions Miami for continued growth as Latin America’s preferred international real estate destination.

The transformation of Miami into Latin America’s real estate capital has created opportunities that extend far beyond individual property transactions. For those positioned to participate in this market, whether as investors, residents, or business leaders, Miami offers access to one of the world’s most dynamic and internationally connected real estate markets.